India is the world’s sixth-largest economy with a young, entrepreneurial population of 1.34 BN (billion), making it a booming investment destination. India is home-ground for some of the most cost-effective IT companies in the world and continues to be a crucial consumer market. For private companies and investors ‘looking East’, India is a promising candidate and an emerging economic hub, especially in South Asia.

While the second wave of Covid-19 has been a setback in early 2021, various macroeconomic indicators indicate a stable recovery. For instance, with increasing digitisation, India saw a historic increase in digital payments (e.g. Unified Payments Interface saw a record 2.8 billion transactions in June 2021).

India is expected to wield its position as a regional force in South Asia, with an expected GDP growth rate of 9.5% in 2022 (even though it is a ‘trimmed down’ forecast, it continues to be one of the highest country-specific GDP growth forecasts by the IMF – making India a rapidly growing country, not just in Asia but also globally).

With a stable government and sound macroeconomic fundamentals, India remains an attractive investment destination among emerging economies.

GOVERNMENT-DRIVEN GROWTH

The Indian government is taking multiple steps to boost local demand and secure its long term growth including:

- A fiscal stimulus package of US$ 84.4 BN ( € ~71.2 BN) introduced in 2021;

- The Emergency Credit Line Guarantee Scheme to revive a pandemic-hit economy and provide guarantees to banks;

- Special efforts to support Micro, Small and Medium Enterprises to infuse liquidity in the economy through credit guarantee schemes.

WIN-WIN POLICY MEASURES

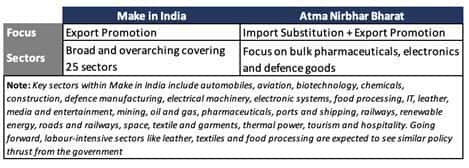

With a vision to make India into a ‘self-reliant’ nation, the Atma Nirbhar Bharat campaign was launched in 2020, giving special significance to ‘Make in India’.

Connecting the dots between Make in India and Atma Nirbhar Bharat

What’s in it for the international community?

While the slogans of self-sufficiency and making in India have mass political appeal, there is an awareness that India cannot achieve this through a ‘closed economy’ model. India continues to be plagued with challenges of being labour-surplus (an unemployment rate of 8.1%, Centre for Monitoring of the Indian economy). There is sufficient room to play, especially in manufacturing where productivity levels remain low and sluggish. International companies can position themselves as adding value, bringing technological improvements, sharing technical-know how to improve productivity in Indian manufacturing.

To sum up, to turn ‘Make in India’ into a reality – trade, investment, infrastructure development, raw material procurement and technology transfer needs to happen (where India heavily relies on developed economies that have achieved greater milestones of technological advancement). In fact, the Indian Prime Minister, cognisant of the country’s limitations, has made multiple public appeals to invest in India for ‘returns with reliability’ while assuring greater ease of doing business (a relative ascend from rank 142 in 2014 to rank 63 in 2020) to encourage international companies to continue to engage with India.

Hence, despite ‘Make in India’ there are plenty of avenues for international companies to strengthen their trade and investment partnership pitch by positioning themselves as technical and technological support to domestic companies under the ‘Atma Nirbhar Bharat’ narrative.

WHICH SECTORS EMERGED AS WINNERS?

Despite external shocks, these three sectors have proven to be pandemic-proof, showcasing positive growth.

a) Fast Moving Consumer Goods – a sunrise segment:

- Consumer goods and FMCG is the fourth largest sector of the Indian economy, built on the back of a growing middle class and burgeoning rural consumption.

- According to Nielsen, the Indian FMCG industry grew 9.4% in the January-March quarter of 2021, supported by consumption-led growth and value expansion from higher product prices, particularly for staples. The rise in Indian rural consumption will continue to drive double-digit growth in the FMCG market, an opportunity space for companies to tap into.

b) Pharmaceuticals – a fast-paced growth story:

- Pharmaceuticals have benefited with higher than projected sales, mainly due to the emerging global healthcare context. According to the Indian Economic Survey 2021, the domestic market is expected to grow 3x in the next decade. India’s domestic pharmaceutical market is estimated at US$ 42 BN in 2021 and likely to reach US$ 65 BN by 2024 and further expand to reach ~US$ 120-130 BN by 2030.

c) Telecommunications – a consumer-driven bullish segment:

- India’s telecom industry is the second largest in the world with a subscriber base of 1.17 BN. The number of broadband subscribers rose to 765.1 MN (million) in February 2021. The industry has witnessed exponential growth over the last few years primarily driven by affordable tariffs, wider availability, expanding 4G coverage and evolving consumption patterns of subscribers. According to a Zenith Media survey, India is expected to become the fastest-growing telecom advertisement market, with an annual growth rate of 11% by 2023.

SECTORS WITH STEADY GROWTH AND A PROMISING FUTURE

1. Automobiles – demand generation for e-vehicles:

- The Indian automotive industry is expected to slowly revive and showcase strong growth in 2021-22. With the opening of showrooms, all categories of vehicles (commercial and private) witnessed a sharp increase in sales by 34%.

- Electric vehicles, especially two-wheelers, are likely to witness positive sales and drive growth. In the long run, the Indian automotive industry (including component manufacturing) is expected to reach Rs.16.16-18.18 TN (trillion) (US$ 251.4-282.8 BN) by 2026. The government’s Automotive Mission Plan initiative lays down the roadmap for the sector’s revival along with tax cuts to push e-vehicles (2 wheelers and 4 wheelers).

2. Manufacturing – long-term gaps in productivity enhancement:

- Manufacturing has emerged as a priority growth sector, with the aim to propel India into a manufacturing hub (with a contribution of 25% to India’s GDP). The government has extended its Production-Linked Incentive (PLI) Scheme to flagship sectors (including mobile manufacturing and electric components, pharmaceutical, and medical device manufacturing). PLI provides incentives to companies for enhancing their domestic manufacturing (apart from focusing on reducing import bills and improving the cost competitiveness of local goods). PLI scheme offers incentives on incremental sales for products manufactured in India. 13 sectors are supported including but not limited to (a) electronic and technology products (b) pharmaceutical drugs (c) telecom products (d) food products (e) high-efficiency solar modules. Hence, there is merit in international companies considering setting up their manufacturing units in India to be able to leverage the government’s PLI scheme (for example in food products processing).

- With impetus on developing industrial corridors and smart cities, the Government expects to improve its productivity parameters and showcase persistent growth in the sector. Increasing the Indian manufacturing sector’s productivity (especially compared to countries like China and Vietnam) remains a key challenge and a white space for companies to engage in.

3. Agriculture and Food – increased interest in marrying technology with an age-old sector

- Historically, agriculture has been the backbone of the Indian industry, currently contributing to 18% of the GDP and employing about 60% of its population. India is the world’s largest producer of milk and pulses. However, the small size of landholdings and low productivity continue to hold Indian agriculture back. With the government attempting to implement the 3 farm laws (Farmers’ Produce Trade and Commerce Act, Farmers Agreement of Price Assurance and Farm Services Act and the Essential Commodities Act 2020) and India’s apex court (Supreme Court) putting a hold on implementing the laws, the regulatory landscape in Indian agriculture is yet to emerge.

- Agricultural technology remains a key area with public and private players heavily investing in the start-up space. FDI in the agri-tech space is anticipated to be worth USD 24.1 BN by 2026. Integrated development of horticulture and aquaculture is being given priority, based on the ecology of states where cultivation is conducive and the economy of certain crops.

- Opportunities exist across the value chain, with ‘farm-to-fork’ supply chains being intertwined with technological changes. (i) Assisting farmers to gain access to timely warehousing facilities (ii) easing the burden of initial investment on farmers (iii) offering the right prices for agricultural produce and (iv) providing machinery to improve productivity (appropriate to land size holding) remain key challenges.

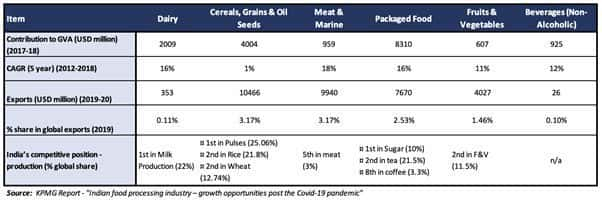

4. Food Processing – a high growth segment with potential for value-add

- India’s food processing market is expected to double from US$ 263 BN in 2019-20 to US$ 535 BN in 2025. India has a Foreign Direct Investment component of US$ 10.24 BN allocated to food processing alone. Initially, because of multiple country-wide lockdowns, there were disruptions in the supply chain (with limited raw material availability, processing plants being shut down, labour shortages as key challenges highlighted by the Federation of Indian Chambers of Commerce and Industry (FICCI)’s food processing industry reports).

- However, with the supply chain roadblocks being solved, the silver lining is that Indian Food Processing Industries have been consistently growing at an Average Annual Growth Rate (AAGR) of 9.99 %.

- The food processing industry was among the least impacted sectors due to Covid-19 (except the meat and marine food segment, which witnessed a negative impact due to low demand – mainly due to initial misinformation campaigns, especially around poultry meat consumption).

- Overall, Covid-19 has had positive ripple effects on the Indian food processing industry. This is mainly because the pandemic has meant a marked shift in consumer tastes and preferences towards processed food. Acceptability of processed food products has increased as consumers shift gears and focus on hygienic, easily available products with long shelf lives.

- The chart highlights the opportunity space in food processing, that can be tapped into by international companies

Unlocking the white spaces in food processing

- Processed fruit and vegetable-based ingredients: Catering to the increasing demand for healthy alternatives, fruit and vegetable-based components have a vast opportunity. This also includes fruit-based ingredients for ice creams, yoghurt and vegetable-based ingredients for beverages and snacks.

- Meat and marine foods processing: The processing industry is a huge opportunity to be explored (e.g. frozen, canned, pulp, puree, paste, sauces, snacks, dressings, flakes, dices, dehydration, pickles, juices, slices, chips, jams and jellies).

- Technology transfers to reduce wastage: Entails providing infrastructure like cold chains, processing and packaging know-how and skill development in post-harvest infrastructure. Knowledge transfers in canning, dehydration, pickling, provisional preservation, and bottling are untapped areas for international companies to plug into.

SUMMING UP

Despite the pandemic, India’s economic performance has and looks likely to be noteworthy (be it through winning sectors like FMCGs, pharmaceuticals and telecom or through steady and promising ones like automobiles, manufacturing, agriculture and food processing). Multilateral development agencies like the IMF and World Bank continue to cite India as an economic success story, outperforming its peers globally, making it an attractive investment destination for international players. The government has invested considerable efforts to improve the business environment in India over the last 5-7 years. International organisations wishing to tap into the market opportunity require tenacity, flexibility and a medium-term investment approach.

International companies with a medium to long term growth strategy and an appetite for initial, short-term gestation period must consider putting India on their international growth strategy map. With Larive and Sannam S4’s technical expertise and in-country hand-holding support, international companies can strike the right cord and make big gains in the Indian market.

– This article is produced by the Sannam S4 and Larive International research and consulting teams.

Cover image: Creative Commons - Flickr - Coffee-channel.com